Menu

COVID-19 and Innovation in Retail

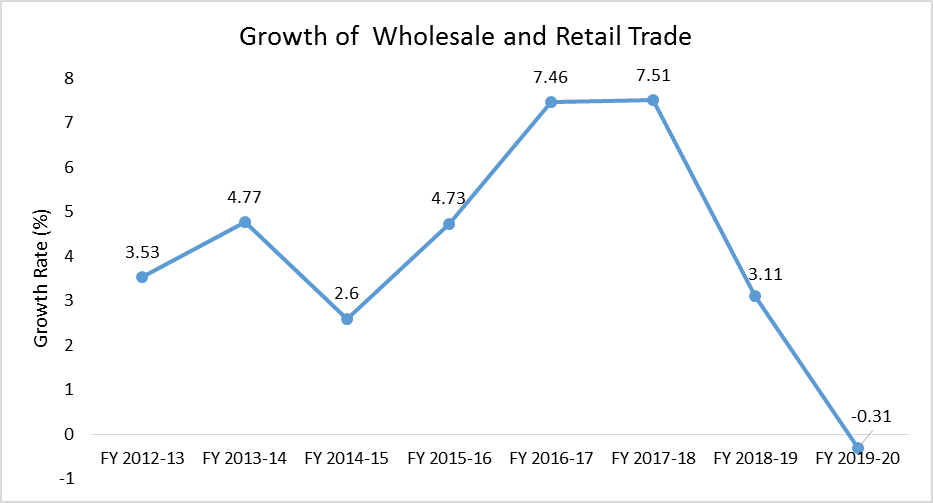

The wholesale and retail trade sector is the largest sub-sector of services in Pakistan, maintaining a growth of 7.5% in the FY 2017-18 and contributing around 18.2% to GDP in FY 2019-20. Within retail trade, around 54% of the retail units are engaged in the sale of food, beverages and tobacco, and 80% of these are located in urban areas, employing 33% of the informal labor force. However, in the recent COVID-19 pandemic, social distancing and the lockdown situation has limited activity for contact-intensive businesses. As a result, the retail sector has witnessed a reduction in spending and has declined by 3.4% in FY 2019-20.

Figure: Growth of Wholesale and Retail Trade

Source: Ministry of Finance[1]

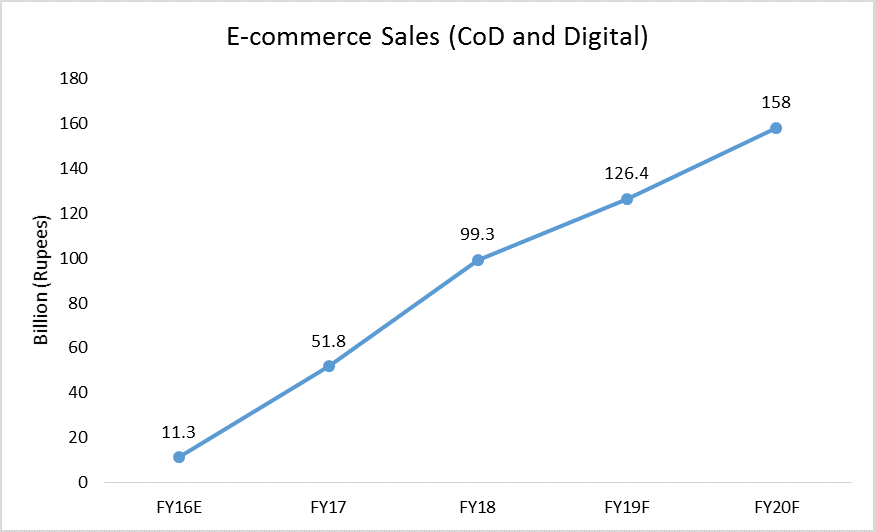

However, with the decrease in sales at physical outlets, retail businesses are increasingly moving towards e-commerce by re-igniting demand for their existing products and services online, diversifying into high-demand products and services during this pandemic, and investing in online payment methods and delivery systems. E-commerce in Pakistan has been growing as reflected by sales in FY18 estimated at Rs.99.3 billion, representing a year-on-year growth of 92%. Sales in this sector were also predicted to increase to PKR. 158 billion in 2020, before the pandemic.

Figure: E-commerce Sales

Source: Ministry of Commerce

Source: Ministry of Commerce

Falling Consumer Demand

In light of the COVID-19 pandemic, consumers’ buying patterns have changed and retailers have witnessed a decline in demand for their products and services. This mostly applies to fashion retailers, who had to close down their retail outlets during the peak lawn season, which coincided with the sudden COVID-19 lockdown. Billions were lost in terms of sales revenue and cash flow problems were exacerbated as retailers’ capital was tied up in incomplete or on-going projects.

Moreover, traditional retailers had to undergo a costly process of adapting their entire supply chains (from production to the customer’s doorstep) to align with the new conditions. Expensive technological infrastructure was developed, consultant services were acquired and safety precautions were taken. Some retailers also opted for innovative strategies using virtual reality and online streaming for product launches, others redesigned their online delivery models, while most retailers also offered substantial discounts to retain customers. There is also a move towards not only check-out free shopping, where customers can scan and pay for their shopping using a screen or smartphone app, but also touch-free shopping, which eliminates the need for physical interaction completely.

Government Regulations and SOPs

Even though the government has constantly engaged with the key players in the retail sector to design effective regulations and has also initiated relief packages for the unemployed, salary cuts and lay-offs have been unavoidable. While government SOPs with regards to COVID-19 have prevented the spread of the outbreak, the officially declared reduced operational hours for retail businesses has to a large degree constrained demand. This is because a significant customer base which preferred to visit outlets during later hours or on the weekend, has been dissuaded. This brings attention to the importance of collecting data on customer footfall in retail shops to help design more balanced policies to not only contain the spread of the virus, but also enforce appropriate operational schedules on retail businesses. This will help sustain some of the dwindling demand caused by the pandemic’s economic fallout.

Difficult Transition to E-commerce

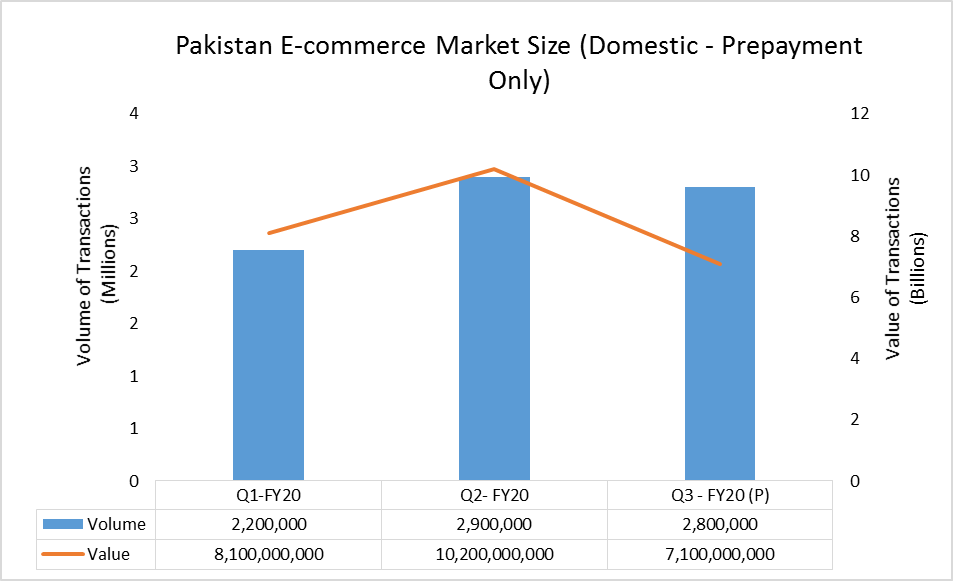

While several traditional retailers have successfully transitioned to e-commerce to maintain and increase their sales revenue during the pandemic, online consumer buying patterns are inherently different. Online consumers are actively looking for low-price or non-branded options. This is a major concern for traditional retailers, who are already incurring high costs at their non-operational physical outlets during COVID-19. It is also important to recognize that although, e-commerce sales increased during the lockdown, they declined when the lockdown eased – indicating that there are several structural issues that may impact long-run growth in this sector requiring consistent efforts. Although, the volume and value of transactions in the e-commerce sector increased during the first two quarters of FY 2020, they have fallen by approximately 100,000 orders in volume and PKR 3.1 billion in revenue during the third quarter due to COVID-19.

Figure: E-commerce Sales

Source: DYL Ventures

Source: DYL Ventures

Consumer Trust Deficit

-

Weak regulatory structure

Another key constraint to maximizing the potential of e-commerce is the lack of consumer trust in this sector. Almost entirely absent consumer protection laws and warranty policies, and their weak implementation explains why most consumers continue to prefer buying from physical retail outlets rather than online e-commerce stores. The traditional retail experience allows consumers to inspect and assess the quality of the product or service, as advertised items sometimes do not match quality depicted in the description and picture online. Moreover, the government is also unable to protect consumers from fraudulent activity online. This also explains why e-commerce customers prefer Cash-on-Delivery (CoD) – it gives them the opportunity to back out of a purchase if the product or service is not of the desired quality. Hence, the government should design and ensure the effective implementation of laws that protect both consumers and retailers online.

-

Limitations in Logistical Technology

Lack of consumer trust and perceptions about low quality of e-commerce products and services has also been triggered due to logistical failures in maintaining inventory depth in the supply chain and ensuring timely deliveries of purchased items. It is important to recognize that Pakistan lags behind in terms of logistics technology, which is essential for the development of e-commerce.

Furthermore, intra-city logistics should be identified as a prospective area of innovation and investment, considering the high level of commerce activity that takes place within cities. There is also an increasing need to move towards an Omnichannel system, which integrates distribution, promotion, and communication channels to provide customers with a unified, seamless shopping experience across all channels or touch points. This approach will ensure that stores have their own stock and serve as online shops or warehouses that sell directly to customers in their vicinity, leading to immense gains in the e-commerce sector.

Other options for retail sector growth include QR code scanning outside retail stores and at home (Amazon model), and transforming traditional market places with fragmented retailers, such as Liberty Market in Lahore, into online market places (Mall of Dubai vertical model).

Payment Systems

In addition to the lack of trust, consumers in Pakistan also rely heavily on CoD because other digital payment options are either not easily accessible or incur taxes. Many banks in Pakistan either do not allow online payments through debit cards or charge an additional amount on debit card payments. Brick and mortar retailers also tack on an additional 2.5% fee on the use of credit/debit cards, which further dis-incentivizes customers from shifting to digital payment systems.

Hence, there is a need to create incentives for consumers to shift towards digital payments. This includes reducing telecom taxes to encourage a parallel mobile top-up currency, lowering sales tax/introducing discounts for digital payments and accounting for elasticities in sales tax policy making. The integration of these recommendations in the tax policy design will not only encourage the use of digital payments, but will also increase tax-payer visibility for the government – effectively increasing the tax base and business activity online.

Moreover, in terms of international payments, PayPal equivalents should be created through close collaboration with the banking sector, especially to facilitate micro merchants. In addition to this, the government should also aim to remove the hurdles in documentation of exports to enhance the potential of e-commerce in Pakistan.

[1] According to the Pakistan Economic Survey of 2019-20, retail sector declined by 3.42% in FY 2019-20 due to COVID-19, indicating a negative growth rate in this financial year.

Kashaf Ali is a Research Assistant at the Consortium for Development Policy Research (CDPR)