Menu

Unlocking Pakistan’s Income Tax Potential

Pakistan currently collects 11.4 percent of GDP in taxes with an estimated tax gap in excess of 50 percent of current collections. A large part of the tax gap is from income tax collections. The widening of Pakistan’s overall tax gap can be attributed to a host of inter-connected factors including fragmented tax administrations, weak enforcement, low compliance, generous and distortionary exemptions and concessions, and narrow tax bases.

Improving income tax is critical for Pakistan to fund service delivery, increase social protection spending and lower compliance costs for taxpayers. With the right policy and administration, income taxes can be the most progressive tax instrument for the government.

Background

Pakistan inherited the tax structure of pre-partition India as per the Government of India Act. After independence, Pakistan adopted the Income Tax Act 1922 as its official income tax law, which was extended to the whole country except some special areas.

Between 1922 and 1979 as many as 71 amendments to the Act of 1922 were passed by the legislature, which made the law cumbersome. To address this, the then government promulgated a new tax law in 1979 to replace the Income Tax Act of 1922. In 2001, the Government of General Pervez Musharraf replaced the 1979 Act by a new tax ordinance. The Income Tax Ordinance of 2001 has so far been amended over 2500 times.

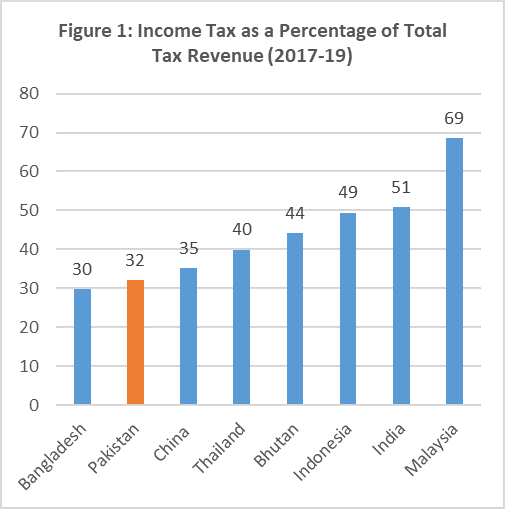

It is important to note that income tax is almost one third of the tax revenue generated in Pakistan, constituting about 32.1 percent of Pakistan’s total tax revenue and 3.7 percent of its GDP in the financial year 2020. In recent years, successive governments have put in place various measures to increase income tax revenues; whether it is by increasing the documentation of the informal economy or bringing improvements in the complex tax code.

Low Performance than Comparator Countries

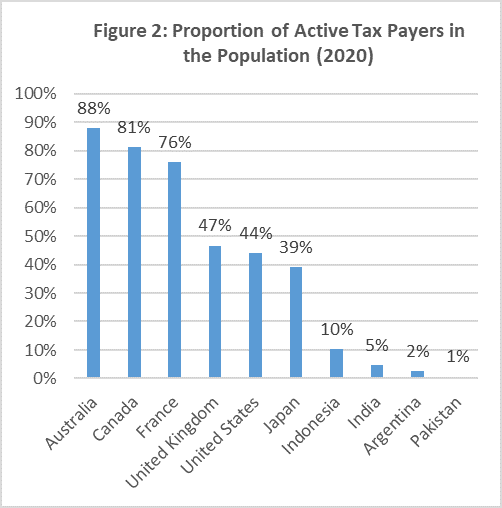

Pakistan’s income tax collection from salary, business, property and capital as well as from other sources is not only less than its comparator countries but also far lower than its own potential. Low tax collection is a result of gaps in both tax policy and administration.

Figure Sources: Figure 1: World Development Indicators (2017-19) and Figure 2: Addressing Pakistan’s Chronic Fiscal Deficit, 2020

Tax Reform Challenges

While, the primary purpose of taxation is to generate revenue, Pakistan had to deal with issues related to a fragmented tax base, generous income tax thresholds and weak enforcement in the past.

A Fragmented Tax Base

Pakistan’s current income tax regime suffers from a fragmented tax base. All non-agriculture income tax is collected by the federal government through the Federal Board of Revenue (FBR), while Agriculture Income Tax (AIT) is collected by provinces at a lower rate. The agricultural income tax gap was recorded at Rs.69.5 billion in the financial year 2020.

While provinces remain reluctant to revise the AIT rates or reform this complicated process, this fragmentation in the tax base has also resulted in significant loss of revenue, as citizens evade taxes by declaring their non-agriculture income as agriculture income.

Generous Income Tax Thresholds

Generous income tax thresholds and rates to make tax structure progressive in Pakistan have also led to extensive loss in tax collection. Larger minimum tax thresholds and lower marginal tax rates for some sectors have further narrowed down the tax base by encouraging tax evasion at the margins. These practices have also overly burdened the compliant sectors, while not enforcing tax law in others. For instance, many sectors of the economy, such as agriculture, continue to remain taxed far below their share in the GDP, while others like petroleum products have been taxed heavily. Such measures not only decrease tax morale and create further distortions in economic activity, but also exacerbate inequality in the country.

Only 2.74 million people file personal income tax in Pakistan, which is just 4.1 percent of the labor force and 1.3 percent of the population in Pakistan. It is important to note that 35 percent of the individual filers pay zero income tax i.e. they fall below the taxable income and did not pay taxes during the year. In addition to this, 64 percent of all filed income tax is from corporate income tax.

Weak Enforcement and Costly Compliance

Tax compliance is costly and difficult because the law on taxation and its practice are very far from each other. While the number of tax filers has doubled from 1 million, due to new prohibitions, tax filers are discouraged to continue filing because of additional questioning of their previous records.

Moreover, the audit and verification of industry’s compliance or tax returns is also a cumbersome process. Although a self-assessment system was one of the biggest achievements in the income tax code, extensive questioning of every single item in the tax returns as well as the companies’ profit and loss statements, and balance sheets in the first assessment order has defeated the purpose of self-assessment.

In addition to this, the verification process is also usually manual, which requires companies to spend additional time translating financial information from their expensive digitized systems.

While weak and slow enforcement allows for rent-seeking opportunities, the number and quality of tax audits is insufficient to correct self-assessment by taxpayers. Currently, the collection on demand is just 4 percent in the country, whereas the rest is reliant on enforcement.

Overreliance on Withholding Tax

In Pakistan, almost 70% of all income tax is collected as withholding tax. To bring more people into the tax net, especially in the informal sector, FBR now levies a high rate on withholding taxes for those not filing their tax returns. However, the international experience is that overreliance on withholding taxes can become counterproductive as instead of bringing more people in the tax net, it may actually reduce them.

Reforming the Income Tax Regime in Pakistan

Harmonization of Income Tax

As a fragmented tax base makes it easier for citizens to evade taxes, it is important to harmonize income tax in Pakistan. The agriculture and non-agriculture income should be taxed on the same principles, preferably by FBR and all collections by FBR should be sent as straight transfers to provinces to reduce provincial administrative costs.

Moreover, it is important to frequently revise the AIT rates to capture value-added, and also use ‘presumptive income taxes’ with appropriate tax rates applied on the difference of estimated value of agricultural outputs and cost of production.

Rationalize Income Tax Rates

It is important to conduct an analysis of the potential loss in tax collection and adjust tax structures in line with regional comparators. Moreover, tax rates should be stable and not change with every finance bill to avoid speculation on tax policy. Pakistan may also consider flat rates versus multiple tax rates but any reform in this direction needs to be viewed in light of its impact on progressivity of income tax.

Widening the Income Tax Base

Currently, the formal economy in Pakistan is over-taxed, while its informal economy suffers from the problem of being under-taxed. This not only narrows down the income tax base, but also discourages people from entering the formal economy due to higher taxes. Currently, the income tax base, including informal economy, is estimated to be around Rs 50 trillion. Hence, it is pertinent that the government focuses on increasing the tax base rather the tax rate for the few, who are taxed.

Improving Tax Administration

It has become increasingly important to strengthen tax enforcement procedures and institute risk-based audits. Strict monitoring measures and investment in human resource capacity building will also be required to improve the performance of FBR.

The complexity that has been brought into the tax code during the past 20 to 25 years is a huge problem for the industry. Hence, automation of the tax systems is pertinent for a successful transition towards a more digitized system with lower compliance costs.

Kashaf Ali is a Research Assistant at the Consortium for Development Policy Research (CDPR).