Menu

Has GSP plus status improved Pakistan’s garments exports?

By Zara Salman

In December of 2013, Pakistan acquired the GSP plus status from the European Union, granting member states duty-free access to 96 percent of Pakistani exports to the EU. Pakistan was the second country in all of South and Southeast Asia to receive the trade advantage, giving it a 10 to 14 percent duty advantage over major regional competitors including China, India, Vietnam, Thailand, and Indonesia.

Between 2013 and 2015, Pakistan’s most important export industry – garments – increased exports by 10 percent. But Bangladesh and India increased their garments exports in the same period by 13 percent and 17 percent, respectively.[1] This shows that Pakistan has not yet fully exploited the benefits of the GSP plus status.

The garments sector has the potential to drive Pakistan’s export-led growth due to high value addition of exported products, high labor intensity, and low energy requirement. In 2015, garments accounted for over 20 percent of total exports. Once GSP plus status was obtained, the garments sector was expected to grow considerably from increased exports and other associated economic benefits. But has that really happened? What needs to be done to fully exploit the potential benefit of the GSP plus status?

A recent study[2] by the International Growth Centre provides evidence to answer these questions.

Impact of GSP plus in numbers

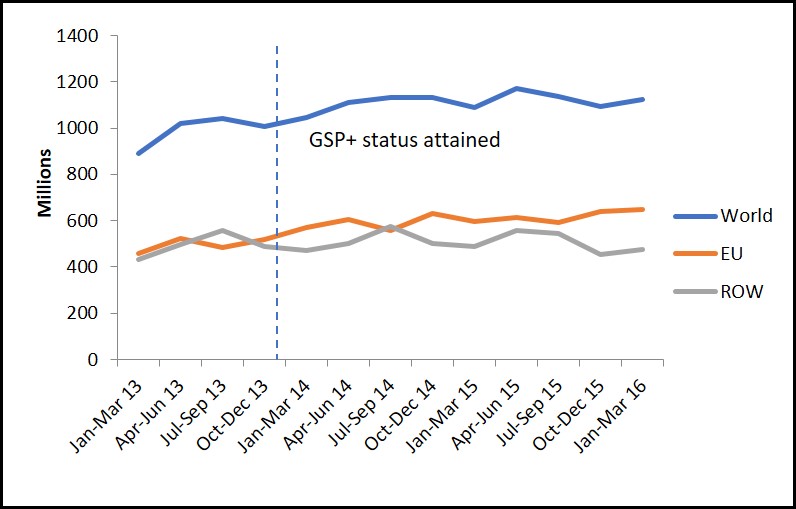

The most recent data confirms that the GSP plus status has positively impacted Pakistan’s garments exports to the EU compared to its exports to the rest of the world (Figure 1). In the first two years of GSP plus, garments exports to the EU grew much faster (at 11 percent per year) than garments exports to the rest of the world (1.5 percent per year).. Between 2013 and 2015, the EU’s share in Pakistan’s total garment exports has also increased from 50 to 54 percent. However, the benefits are probably less than initially projected.

Figure 1: Pakistan’s Garments Exports (2013-2015)

Source: UN Comtrade

Analyzing specific garment categories, exports of knitwear to the EU expanded faster (at 6 percent per year) than of woven (at 5 percent per year) after GSP plus status. [3] Yet, this pace of growth is only visible for the EU, as knitwear exports to the rest of the world grew slower than woven garments exports (6 percent per year versus 7.5 percent per year, respectively).

Figure 2: Pakistan Garments Exports by Categories

Source: UN Comtrade

What is holding back gains from GSP plus?

Despite some evident growth in garments exports, the private sector does not seem too optimistic about realizing the full potential of GSP plus and has vocally expressed frustration at the challenges that remain.

Their biggest concern is the continued energy shortfall. In the last few years the industry has operated below 70 percent of full capacity due to this deficit. Production costs have also increased as firms employ alternate measures to ensure regular energy supplies. The energy crisis is expected to lessen in the coming years as investments on energy projects planned under CPEC materialize. But in the interim, industry continues to struggle with meeting production targets.

Pakistan’s adverse business climate hinders investments in export manufacturing particularly by new EU-based clients. International buyers prefer suppliers from less risky countries, especially where physical engagement with firms is possible. Maplecroft, an international agency that ranks countries according to their investment climate, places Pakistan in the high-risk category. Pakistan fares much worse than Bangladesh on most categories (Table 1). Without a coherent strategy to improve the business environment, the gains of GSP plus will not be fully availed.

Table 1: Risk Rating for Pakistan and Bangladesh

| Pakistan | Bangladesh | |

| Political Risk | 8.34 | 7.21 |

| Social/Compliance Risk[4] | 8.82 | 8.46 |

| Economic Risk | 6.42 | 6.22 |

| Infrastructure Risk[5] | 9.47 | 9.62 |

| Adjusted Country Risk Score | 8.26 | 7.88 |

| Overall Risk Rating | Extreme | Extreme |

Note: The agency analyzes countries at different risk levels on a scale of 1 to 10 (1= Best and 10= Worst).

An important challenge faced by the industry is the tax regime and custom clearance procedures. The industry is subjected to a higher duty on raw materials compared to other countries, which makes the final product more expensive.[6] Due to cumbersome customs procedures and high duties on the import of artificial fibers and PTA[7] (a raw material for the manufacture of polyester), the garments industry has been unable to move from the existing cotton concentrated 80:20 mix to the globally demanded 50:50 mix in its exports.

The verdict

On the bright side, GSP plus status has allowed the garments industry to maintain its export shares – even improve them slightly – despite the many challenges. The new incentive package for exporters, announced by the Prime Minister in January 2017, may ease some of the tax constraints. [8] There is also some progress towards solving the energy crisis and lowering the tax burden.

But the desired benefit of the GSP plus status – substantially higher exports – will be realized only when the energy, tax and customs challenges are addressed comprehensively. Improving Pakistan’s business environment will also be key to attracting foreign clients including Chinese investors, given that the Chinese garment industry is relocating to lower-cost developing countries and Pakistan offers the additional advantage of easy access to European markets.

Zara Salman is a senior research associate at the Consortium for Development Policy Research.

[1] World Trade Organization

[2] Nabi, I & Hamid, N. (2016). Implementing Policies for Competitive Garments Manufacturing.

[3] Knitwear held a greater share of total world exports (at 53 percent) compared to share of EU exports (39 percent) back in 2013

[4] Includes labour and safety laws and human rights.

[5] Includes power, roads, climate change and disaster management

[6] The government, in response to the demands of the spinning industry, has imposed a duty on imported cotton yarn ranging from 5 to 15 percent, which makes products more expensive than that of competitors. Furthermore, taxes paid by exporters on local raw materials are eligible for refund but significant delays and costs are involved in the refund process. Although zero-rated tax regime has been introduced, billions of rupees pending with the FBR for earlier cases remain to be refunded.

[7] Firms face the problem of having to first pay import duties on small items such as tags, zips and other trimmings used in manufacturing of garments and then getting their refund, which is a hassle for them. Moreover, a 24/7 custom clearance facility is officially available, but staff is commonly absent and collectors are available only five days a week, which delays shipments and may lead to loss of clients.

[8] The package includes removal of both customs duty and sales tax on the import of cotton, of customs duty on man-made fibres other than polyester and of sales tax on the import of textile machine. In addition, garments exports will be eligible for duty drawbacks at 7 percent. However, exporters will get these incentives only if they increase exports by 5 percent from January to June 2017 and then by a further 10 percent during FY 2017-18.